tsly dividend history is important for investors who want to understand how this company has rewarded its shareholders over time. By looking at the dividend history, you can see when the company paid dividends, how much it paid, and how consistent it has been. This helps both new and experienced investors make better decisions about buying or holding the stock. tsly has a record of paying dividends that shows its commitment to returning value to shareholders. Many investors like to track these patterns to plan their investments wisely.

Studying tsly dividend history also gives insights into the company’s financial health. If dividends grow steadily, it often shows strong earnings and good management. On the other hand, sudden cuts or missed payments may signal caution. Understanding this history can help investors predict future dividend trends and make smarter choices. Whether you are a long-term investor or just starting, knowing the tsly dividend history is a key step in building a successful investment plan.

Table of Contents

Overview of tsly Dividend History: What Investors Should Know

tsly dividend history shows how often the company pays its shareholders and the amount of these payments. Dividends are usually given as a way to share profits with investors. For many people, dividends are an important part of their income from investments. By studying tsly dividend history, you can see the reliability of these payments. Companies with regular dividend payments are often considered stable and trustworthy.

Investors look at this history to decide whether tsly is a good choice for their portfolio. A consistent dividend history means the company has steady profits and strong management. On the other hand, inconsistent dividends may make investors cautious. Knowing the full tsly dividend history helps investors plan for both short-term and long-term goals. It also allows them to compare tsly with other companies in the same industry to find the best investment option.

How tsly Dividend History Shows Financial Strength

tsly dividend history can reveal how financially strong the company is. A company that can pay and increase dividends consistently usually has stable revenue and profits. Investors see this as a sign of reliability. For example, if tsly has been paying dividends for many years without missing any, it shows strong financial health.

The history also helps investors understand the company’s priorities. Some companies focus on reinvesting profits instead of paying dividends. But tsly’s dividend history shows its commitment to rewarding shareholders. This can make investors feel confident in holding the stock for a longer period. A strong dividend history often attracts new investors and keeps current investors happy.

Key Years in tsly Dividend History and Important Payouts

Looking at tsly dividend history, certain years stand out because of higher or lower payouts. These key years help investors understand how the company performed during good and bad economic times. For example, a year with increased dividends might indicate strong profits, while a lower payout could show challenges the company faced.

Investors can use this information to predict future trends. By studying which years had higher payouts, they can see patterns and plan their investment strategy. Key years in tsly dividend history also show how flexible the company is in adapting to market changes while still rewarding shareholders.

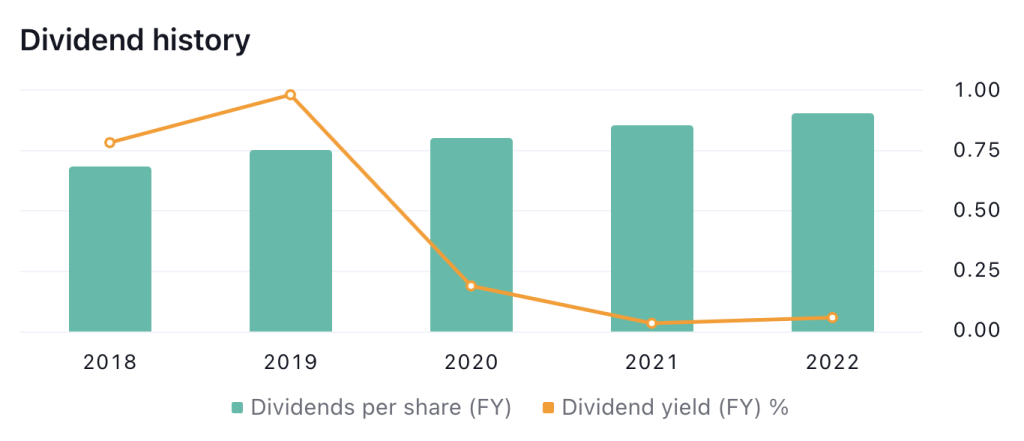

How to Read tsly Dividend History Charts and Data

tsly dividend history is often shown in charts and tables. These charts display dividend amounts over the years and help investors quickly understand trends. Reading these charts is not difficult. You can look for patterns, such as consistent growth or sudden drops, to make better investment decisions.

For beginners, focusing on total annual dividends and the payout frequency is enough. Advanced investors may also look at dividend yield and payout ratio. Understanding tsly dividend history charts can give a clearer picture of the company’s financial health and help in comparing it with other stocks.

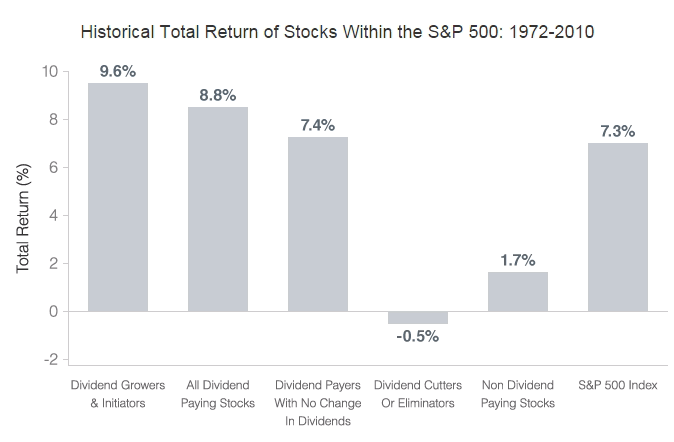

tsly Dividend History Compared to Other Companies in the Industry

Comparing tsly dividend history with other companies in the same sector helps investors find the best options. If tsly pays more consistent dividends than competitors, it may be a more reliable choice. Some companies may pay higher dividends but do it irregularly, which can be risky for investors who rely on income.

By reviewing tsly dividend history alongside other firms, investors can make smarter choices. It also helps in understanding the company’s strategy. A strong history compared to peers may indicate better management and profitability.

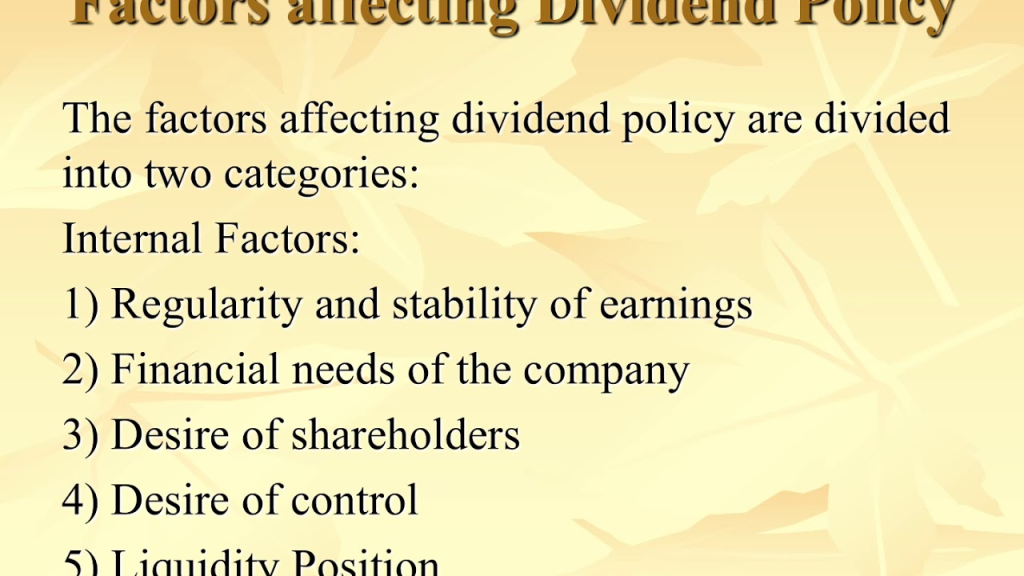

Factors That Affect tsly Dividend History and Growth

Several factors affect tsly dividend history. Company profits, management decisions, market conditions, and economic challenges all play a role. For example, during a financial downturn, tsly may reduce dividends to maintain stability. On the other hand, strong earnings may lead to higher dividends.

Understanding these factors helps investors predict changes in future payouts. It also explains why certain years had higher or lower dividends. Studying tsly dividend history in the context of these factors gives a complete view of the company’s financial performance.

Understanding tsly Dividend History: Frequency and Patterns

tsly dividend history shows not just the amount but also the frequency of payments. Some companies pay dividends quarterly, others yearly. By analyzing frequency and patterns, investors can plan their income. Regular and increasing payments are signs of financial health and good management.

Patterns in tsly dividend history also help in predicting future payouts. For example, if dividends increase steadily every year, investors can expect similar trends in coming years. Understanding these patterns is useful for both new and experienced investors who want to rely on dividends as part of their income strategy.

How tsly Dividend History Helps Long-Term Investors

Long-term investors benefit greatly from studying tsly dividend history. Consistent dividends provide regular income and help in compounding returns when reinvested. By analyzing past dividends, investors can make better predictions about future income streams.

A strong tsly dividend history also shows the company’s resilience. Investors can feel confident that the company can weather market changes while still rewarding shareholders. This makes tsly a good choice for those planning to hold stocks for many years.

Common Questions About tsly Dividend History Answered

Many investors have questions about tsly dividend history, such as:

- How often does tsly pay dividends?

- Has tsly ever reduced dividends?

- How does tsly’s dividend compare to competitors?

By reviewing past payouts and patterns, investors can answer these questions and make informed choices. Understanding tsly dividend history helps reduce risk and improve investment planning.

Trends in tsly Dividend History Over the Last Decade

The last ten years of tsly dividend history show important trends. If dividends have increased steadily, it indicates growth and financial stability. If there are fluctuations, it may show responses to economic conditions.

Tracking these trends helps investors understand how the company performs over time. Long-term patterns in tsly dividend history provide a roadmap for predicting future payouts and planning investment strategies accordingly.

Conclusion

tsly dividend history is a valuable tool for investors who want to make informed decisions. It shows how the company has rewarded shareholders, the patterns in payouts, and the overall financial health of tsly. By analyzing past dividends, investors can plan for income, predict future trends, and compare tsly with competitors. A strong and consistent dividend history indicates stability, reliability, and good management, which are key factors for successful investing.

FAQs

Q1: What is tsly dividend history?

A1: It is the record of all past dividend payments made by tsly to its shareholders, showing amounts, frequency, and trends.

Q2: Why is tsly dividend history important?

A2: It helps investors understand financial stability, plan income, and predict future payouts.

Q3: How often does tsly pay dividends?

A3: The frequency can vary, but most dividends are paid quarterly or annually depending on company policy.

Q4: Can tsly dividend history predict future payouts?

A4: While not guaranteed, past trends provide insights into potential future payments and growth patterns.

Q5: How can I use tsly dividend history for investment planning?

A5: Investors can analyze past payouts to estimate income, decide on reinvestment, and compare tsly with other companies in the industry.